In 2022, the Hannover Fair was back. True, 2,500 exhibitors were only about half of what they had been in pre-pandemic times, and even 75,000 visitors did not add up to a jubilant figure for 75 years of Hannover Fair. Nevertheless, most of those involved were satisfied that the fair was back. For the special industry of industrial software providers, there was a lot that was new, but much harder to find. And that had nothing to do with the pandemic. In general, there was not much sign of a return to normality at the trade fair. (all photos Sendler)

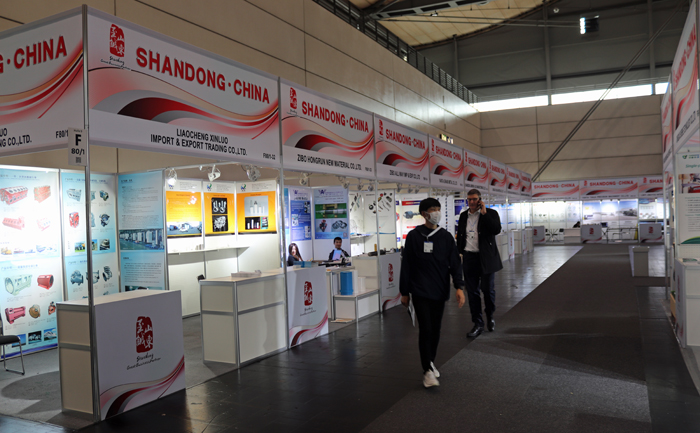

The fact that the Hannover Fair came up with smaller exhibitor numbers surprised no one. Compared to 2019, 1,300 exhibitors from China alone were absent because Xi Jinping’s zero-covid strategy made it impossible for them to appear internationally. Empty stands in Hall 9, for example, almost without staff as well, gave the impression of a phantom economic power, which of course absolutely does not correspond to reality.

Numerous areas in many halls were separated by walls. So, despite the smaller number of visitors, one almost had the impression of the old days. Lots going on, good conversations, and everywhere noticeable relief that people could talk to people instead of watching videos on the screen.

After a forced break of two years, the change in the industrial software sector stood out as if it had taken place abruptly from one day to the next. In Hall 4, three years ago still one of several main halls for this industry, the rows had thinned out. Large booths from Autodesk, Dassault Systèmes and SAP stood out, and Google also made a point of underlining its claim to a role in the industry with a large booth alongside Microsoft. Amazon Web Services exhibited next door in Hall 5. But what one searched for in vain were stands from Siemens and Eplan. PTC had not been interested in its own presence for some time and was represented with demos at several booths of industrial customers this year.

At Siemens, a years-long dispute over a separate industrial software booth separate from the main booth, which they always had, has apparently been settled. Siemens Digital Industries Software became part of the large Siemens stand in Hall 9, and visitors already had to search for the individual CAD and PLM exhibits. However, the impression that software for industrial core processes has actually become an integral part of the overall hardware and software offering from industry giant Siemens does not really reflect how separately the various divisions still operate.

At Eplan, it was precisely this integration that was emphasized at a press event. Eplan no longer sees its products as a stand-alone offering, but as part of the overall strategy of the Loh Group. The press event was then a joint event of Rittal, Eplan, Cideon and German Edge Cloud, the sibling companies of the Loh Group.

There seems to be a major shift in the industry. Apparently, after some 30 years of ascent, it is at a point where more or less all players are looking for a reorientation. And it’s not about the type of license and the use of the cloud. Simply by buying standard software, no industrial company is likely to achieve a competitive advantage today.

The interaction of hardware and software for new types of service business is increasingly coming to the fore. So is the sharing and exchange of industrial data across the boundaries of proprietary systems. Good example: Cybus Connectware from Hamburg, a still very young company, was new in Hall 4. Such examples will probably become more numerous in the coming years. Industry innovation is taking place in a variety of fields, where IT providers that are still completely unknown are offering completely new solutions.

Over the past ten years, the Hannover Fair has become the trade fair engine of industrial digitalization. Here, too, however, it has not been possible to give a noticeable boost to digitalization in small and medium-sized enterprises, which has been severely slowed down for a variety of reasons. The wanton redefinition of SMEs doesn’t help either. Not even when a business medium such as the Handelsblatt wrote on 30.5.22: “However, industrial companies such as Siemens, Bosch and Schneider Electric form the core of the trade fair. Industrial SMEs, from robot manufacturer Festo to the Beckhoff Group and Phoenix Contact, are also strongly represented.” To call Festo and Phoenix Contact, each with more than 20,000 employees, and the Beckhoff Group, with 4,500 employees, industrial SMEs is nonsense. 95 percent of German industrial companies have fewer than 500 employees. That is the industrial SME sector.

This order of magnitude has no lobby, not even at the trade fair and in its supporting associations BDI, ZVEI and VDMA. This became clear at the three-association press conference on the Monday morning of the trade show, at which, by the way, there were initially less than 20 press representatives, and towards the end there were almost 40. In response to my question as to what the BDI intends to do to support the industrial SMEs, which continue to be digitally disconnected, in their digitalization efforts, BDI President Prof. Siegfried Rußwurm replied: “I do not share the assessment that SMEs are lagging far behind here. It is not the case that SMEs in Germany need hand-holding, either from their associations or from politicians.(…) Let’s stop constructing an opposition between SMEs and large corporations. The recipe for success in German industry is that these two groups of companies, if you want to call them that, work together quite symbiotically.” What was my question again? What the BDI intends to do. Rußwurm’s answer, not explicitly given in the unctuous words: Nothing.

Dr. Gunther Kegel, president of the ZVEI and Rußwurm’s vice president in the BDI, substantiated the non-existence of digitalization problems in medium-sized companies by pointing to himself as a good example of a medium-sized company. He was referring to the company he heads, Pepperl+Fuchs, which currently has 5,900 employees. According to the Federal Statistical Office, all companies with more than a thousand employees are large companies. There were exactly 697 of these in Germany, according to the 2019 Statistical Yearbook. They, and only they, have a voice in associations and in politics.

What is frightening is not that the lobbyists do not want to acknowledge this. The frightening thing is that Germany is also dependent on the 99 percent of smaller companies in industrial digitalization. Otherwise, Germany will sink into insignificance when it comes to digital transformation. For the chief lobbyists, there is certainly still a future. For the industry as a whole, things look rather bleak.

Nevertheless, it will be exciting again at the Hannover Fair, which is scheduled to take place again at the end of April starting next year, if Corona follows the guidelines. Many small and young innovators are entering the fray and may change the overall picture. It will again be worthwhile to look at this picture in Hannover.